Helium 10 vs. AMZ Tracker

Amazon FBA sellers confront an ongoing test: securing a competitive edge in an ever-expanding digital marketplace. As millions of listings compete for clicks and conversions, using the right analytical and management tools can separate profitable operations from those that struggle to break even.

Two contenders frequently cited in conversations among Amazon merchants are Helium 10 and AMZ Tracker. While each platform promises to simplify everyday tasks, they do so by playing to slightly different strengths. This detailed side-by-side evaluation aims to clarify which service may mesh more effectively with your particular business model, financial limitations, and long-term objectives.

What is Helium 10?

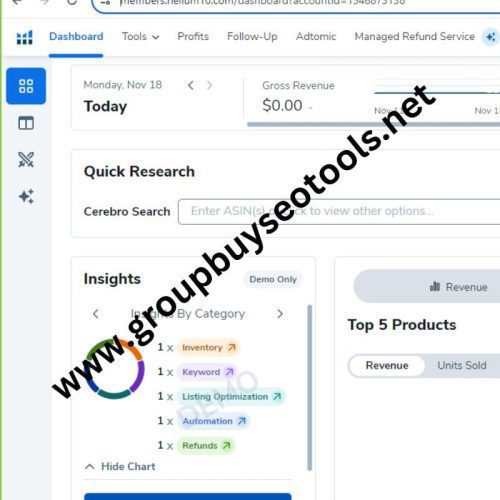

Helium 10 markets itself as a complete toolkit for would-be and seasoned Amazon sellers alike. Launched in 2015, it claims to support over two million merchants across diverse product categories and global marketplaces. In practical terms, the software bundles functions for product discovery, keyword research, listing audit, inventory forecasting, and performance tracking onto a single, unified dashboard.

Its main appeal lies in that breadth. Instead of zeroing in on one phase of selling, Helium 10 follows the seller every step, from choosing a first SKU through iterative optimization and eventual scaling.

Key Helium 10 Features

Product Research Tools.

Black Box guides sellers to lucrative niches by combing through Amazon with filters for price, sales estimates, and competitive density. Once a prospect appears, Xray drills deeper, revealing estimated units sold, revenue, and other performance indicators from the actual listing.

Keyword Research and Optimization.

Magnet compiles a long list of keyword ideas by analyzing the seed phrase or ASIN entered. Cerebro flips the lens, pulling in competitor terms so sellers can see which search strings draw traffic to rival products.

Listing Optimization.

Scribbles scans a draft and flags spots where target keywords should appear, helping users avoid stuffing yet still meet Amazon’s visibility needs. For larger keyword batches, Frankenstein trims duplicates and verbs, making the final list lean and ready for campaigns or the back end of the listing.

Inventory and Operations Management.

Beyond marketing, Helium 10 tracks stock forecasts, flags refund opportunities, and pulls in review scores. These combined pieces let sellers keep cash flowing and dashboard metrics in the green.

What is AMZ Tracker?

AMZ Tracker first opened its doors in 2014, quickly zeroing in on keyword tracking and rank checks. Because it shelves some of the wider tools found in alternatives, the service aims to perfect the narrow road it walks.

That focus attracts sellers willing to trade a multipurpose kit for deep, reliable monitoring of keywords, categories, and daily position shifts.

Key AMZ Tracker Features

Keyword Rank Tracking

AMZ Tracker excels at showing how your products rank for selected keywords over time. It follows positions on several Amazon marketplaces and builds a detailed historical record you can review.

Competitor Monitoring

You can set up alerts to watch rival listings, see how their ranks change, and know right away when a significant movement happens in your niche.

Review Monitoring

The tool tracks reviews on your own products as well as competitors. It sends notifications when new comments appear, giving you a chance to reply quickly to customer feedback.

Basic Product Research

AMZ Tracker’s discovery features are not as in-depth as Helium 10’s, but they still help sellers spot potential products that could perform well.

Pricing Comparison

Helium 10 Pricing Structure

Helium 10 has four main plans:

- Free Plan: Access to most tools, though usage is limited.

- Starter Plan (37/month): Basic entry to the core features.

- Platinum Plan (97/month): Broad access to most tools.

- Diamond Plan (197/month): Everything included, plus advanced training and priority support.

The service often runs sales and lower rates for anyone who signs up for a full year.

AMZ Tracker Pricing Structure

AMZ Tracker offers three straightforward pricing tiers:

- Pro Plan: $50 per month; tracks up to 250 keywords and includes core features.

- Premium Plan: $100 per month; adds advanced tools and increases tracking limits.

- Enterprise Plan: pricing by quote, geared toward sellers with extensive portfolios.

Compared to rivalling tools, AMZ Trackers fees are easy to grasp and clearly separate what each plan delivers.

Feature-by-Feature Analysis

Product Research Capabilities

Helium 10 stands out in product-research capacity. Its Black Box and Xray systems run deep, scanning markets under multiple filters and pinpointing viable niches. The seamless workflow lets sellers jump from wide opportunities straight into detailed item assessments.

AMZ Trackers product explorer is serviceable, yet it does not match the depth and polish of Helium 10. Sellers who prioritise extensive market drilling will find Helium 10 better suited to their needs.

Keyword Research and Tracking

In keyword discovery and tracking the picture is more mixed. Helium 10s Magnet and Cerebro of tools dig up thousands of terms and lay bare competitor moves. By pairing broad searches with side-by-side rival views, the platform helps users shape sharp, data-driven listings.

Keyword Tracking and Monitoring

AMZ Tracker is built around keyword tracking and monitoring. Although it includes only a handful of keyword-discovery tools, its monitoring features are strong and dependable. Sellers who have identified their target terms already and want to watch their performance closely will find AMZ Tracker’s narrow focus appealing.

User Interface and Experience

Helium 10’s dashboard mirrors its wide range of tools and options. Because so many features appear on one screen, newcomers sometimes feel lost. The company has responded by reorganizing menus, adding short tutorials, and guiding first-time users through key tasks. The improvements make the interface markedly easier to navigate than in earlier versions.

AMZ Tracker, in contrast, presents a simpler layout. Fewer buttons and tabs mean users can locate main functions almost immediately. As a result, new account holders usually start running reports with little delay, and most seasoned sellers come to rely on the platform with only minimal training.

Data Accuracy and Reliability

Since Amazon does not publish official unit-sales numbers, estimating success on the platform is inherently tricky no matter which tool is used. Helium 10 relies on a series of proprietary models to guess sales, revenue, and other metrics. While those figures are commonly cited and often move in the right direction, users are encouraged to view them as rough guides instead of firm counts.

AMZ Tracker, by contrast, zeroes in on rank shifts and keyword visibility, areas where results can be checked against real search results. Its ranking data tend to stabilize quickly, and experienced sellers report that the ranks mirror what they see when testing search terms themselves. For pure rank monitoring, many users therefore consider AMZ Tracker somewhat more dependable for real-time checks.

Integration and Ecosystem

Helium 10 Integrations

Helium 10 connects with a wide array of services commonly used by Amazon sellers, including inventory management platforms, accounting programs, and other applications that support Fulfillment by Amazon (FBA) operations. By allowing these systems to speak to one another, Helium 10 helps sellers maintain smoother workflows and centralized data.

Because the suite covers such diverse tasks, many sellers find they can manage most of their reporting, listing optimization, and keyword tracking within Helium 10 alone, lessening the need to pay for multiple subscriptions to separate tools.

AMZ Tracker Integrations

AMZ Tracker, in contrast, offers a narrower range of built-in integrations but emphasizes straightforward data export and open APIs. This approach suits sellers who already operate several specialized programs and wish to plug AMZ Tracker into their established pipeline without the overhead of switching entire systems.

Which Tool Is Right for Your Business?

Choose Helium 10 If:

- You want a single, unified platform that touches nearly every stage of the Amazon selling process. New sellers, in particular, appreciate being able to handle keyword research, profit analysis, and listing upgrades without jumping from app to app.

- Product discovery drives your revenue. Frequent searches for hot items or expansions into unfamiliar marketplaces make Helium 10’s dashboard-valued investment, and the suite almost pays for itself when the right opportunity is found.

- You are comfortable navigating a busier interface for the sake of having tools linked together. The convenience of cross-platform reporting and metric comparison often outweighs the temporary learning curve.

Choose AMZ Tracker If:

Monitoring keyword rankings is your top priority and you need granular performance data for established listings. Its straightforward tools fit sellers who already know what to follow and just want reliable numbers.

You value a clean, uncluttered dashboard that shows data quickly instead of diving into every conceivable detail.

Price matters for you and the advanced extras in Helium 10 feel surplus to requirements.

You have separate tools for other tasks and simply want a lightweight solution that tracks rankings without overlapping work.

Making the Right Choice for Your Amazon Business

Choosing between Helium 10 and AMZ Tracker comes down to where your business sits today, how comfortable you are with data, and what you plan next. Novice sellers often appreciate Helium 10s broad toolkit, while more-seasoned vendors may lean toward AMZ Trackers lean, focused reports.

Try the free trials offered by both services. Run through the features you depend on, see which layout fits your eyes, and feel which workflow doesnt slow you down. The tool that wins is the one you open first, not the one with the fanciest list of bells.

Remember, neither platform stands still. Fresh updates appear every quarter, so picking one now wont chain you for a decademost sellers shift tools as their stores grow, budgets widen, and new needs emerge.